Monet Money

FinTech

Year

2021-2024

Website

Full time (in house)

My Role

Lead Product Designer

Product

Objective

Led the design evolution of MONET as it transformed from a B2C platform for freelancers into a scalable B2B FinOps solution for agencies in the $249B creative economy. Our early B2C phase gave us rich insights into the real financial pressures faced by creatives, ultimately shaping a strategic pivot that paid off fast.

The shift to B2B tripled our active customers within a year, lifted NPS from 3.5 to 7.5, and cut acquisition costs by 80% through a redesigned onboarding experience.

As Lead Product Designer, I owned the product vision end-to-end — from building intuitive tools for instant payouts and financial planning to creating a cohesive design system and delivering a user-centric platform that helps agencies stabilise cash flow, reduce financial risk, and plan sustainably.

The website and brand experience were also designed by me and built in-house

Process

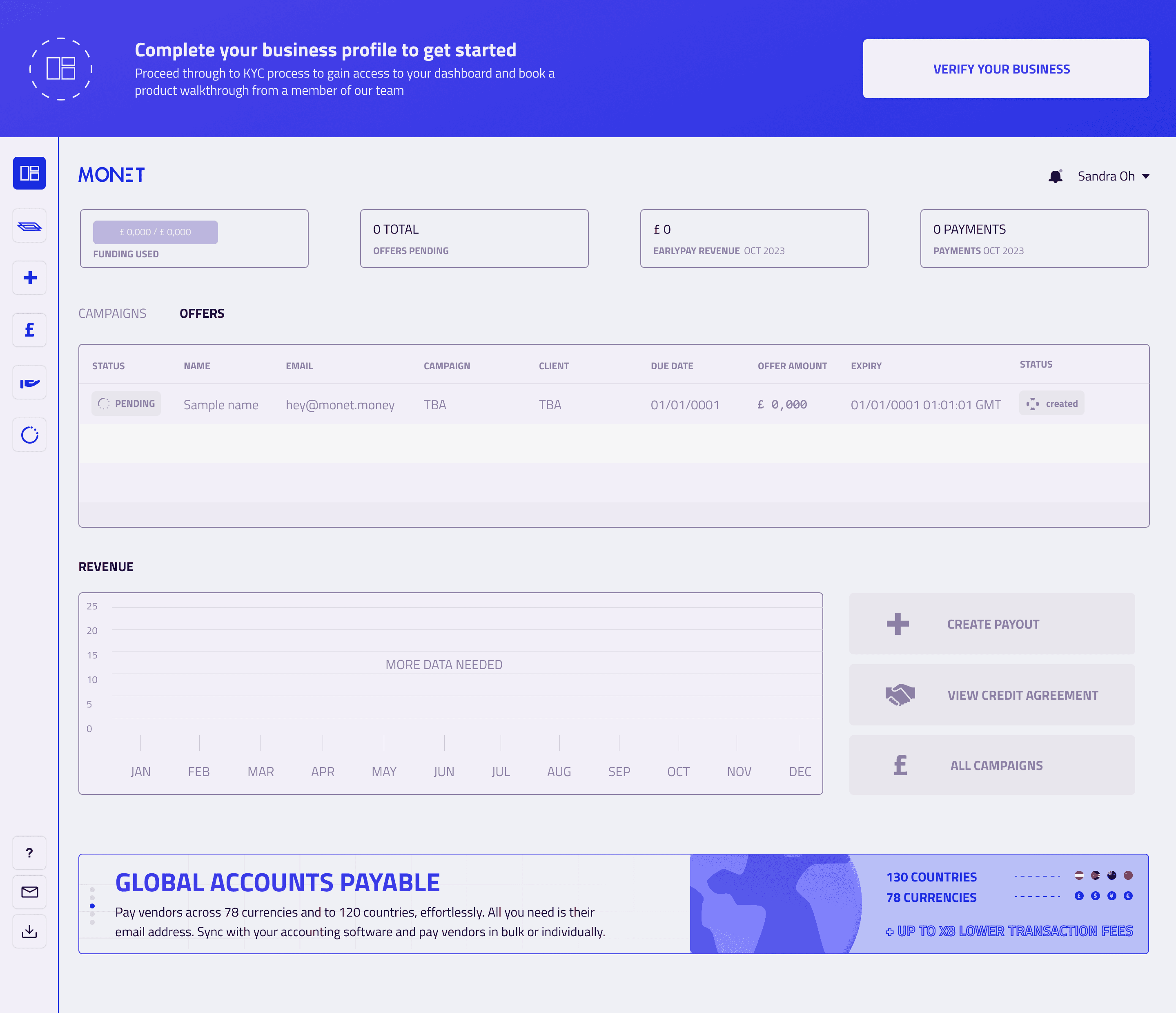

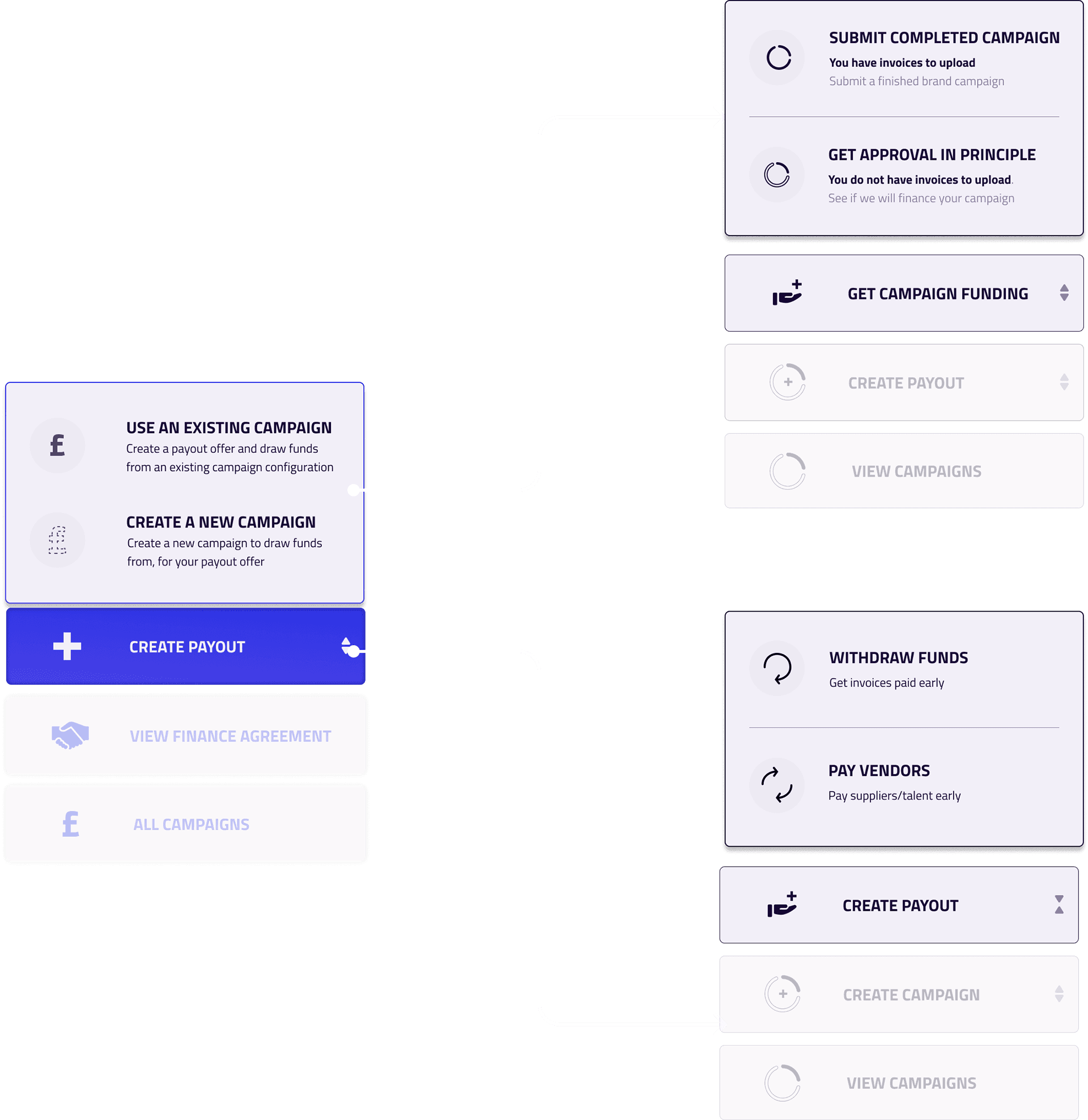

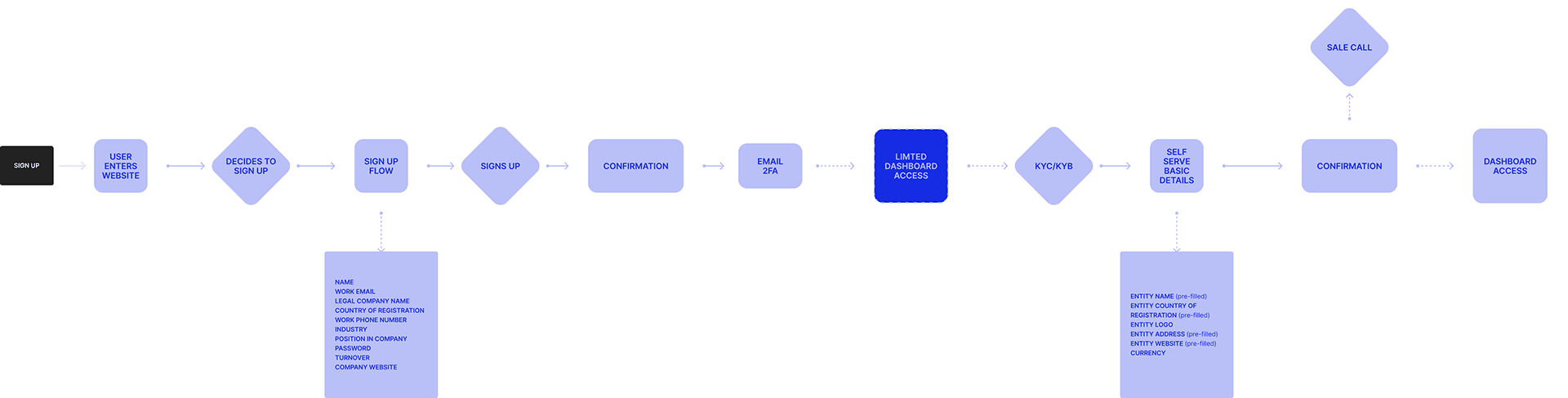

I approached MONET’s redesign through a deeply user-centric and data-driven process: starting with interviews, surveys and persona creation to truly understand both freelancers’ and agencies’ pain points; from volatile cash flow to slow invoice cycles. From those insights I mapped user-journeys and developed wireframes and prototypes, then built an MVP dashboard with a clean, three-call-to-action structure to validate assumptions quickly while minimising friction and engineering overhead.

Parallel to the UX work I created and evolved a design system: initially for the B2C side, with fonts, icons, and brand elements tuned for trust and creativity; then scaling and refining that system for B2B to deliver a more structured, professional aesthetic tailored to agencies and CFO-level users.

As features matured, I used real user data and feedback to guide the next design iterations, for example splitting the dashboard flow to better match agency workflows (one path for campaign invoice financing, another for vendor payout links). This iterative, feedback-led approach ensured every UI decision balanced business goals, user needs, and technical constraints, resulting in a polished, scalable, and user-focused B2B FinOps platform.

[IX + Wireframes below]

Outcome

The redesign and pivot of MONET delivered strong, measurable results. After transitioning from a B2C platform for freelancers to a B2B FinOps solution for agencies, active customers tripled within 12 months and the platform’s NPS rose from 3.5 to 7.5.

Meanwhile, by optimising onboarding and streamlining the user journey, customer acquisition costs dropped by 80 %. As a result, MONET evolved into a stable, scalable, and agency-ready FinOps platform; proving that a user-centred design and data-driven pivot can translate directly into strong business growth and customer satisfaction.

Have a look at some walkthroughs of the live platform below:

Customer acquisition costs reduced

The shift to a self-serve onboarding funnel and automated KYB/KYC workflows allowed our sales team to focus their efforts on converting high-value users, significantly reducing acquisition costs

Conversion Rate Increased

Finance platforms traditionally face challenges in converting users to paid subscriptions, but through a strategic blend of intuitive design and personalised human sales tactics, we successfully increased our conversion rate.Website traffic increased by 150%

Designed in-house using WebFlow, we combined educational content about our lending product with clear CTAs and a preview of upcoming features, this way we informed our target audience but also channeled visitors directly into the platform's new sign-up funnel.

Standout Features

Instant invoice financing to smooth agency cash flow.

EarlyPayout for instant global vendor and talent payments.

Campaign-level financial management in one unified dashboard.

Streamlined, self-serve workflows built for speed and clarity.

Customisable financing fees with optional agency margins.

Scalable B2B design system tailored to complex agency operations.

*Bonus: Have a look at how we integrated B2C principles and the consumer facing flow below on the mobile prototype

Research + Personas

MarComs